金曜日の株式は、住宅と製造業のポジティブな指標と欧州からの強気のコメントにより不安定な週を大幅反発で終わる。

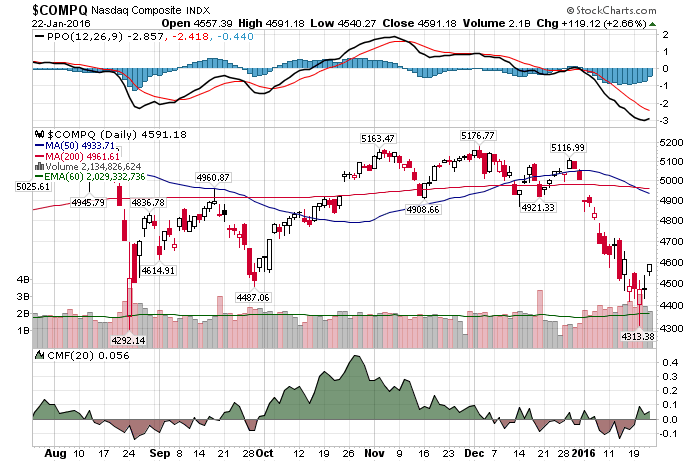

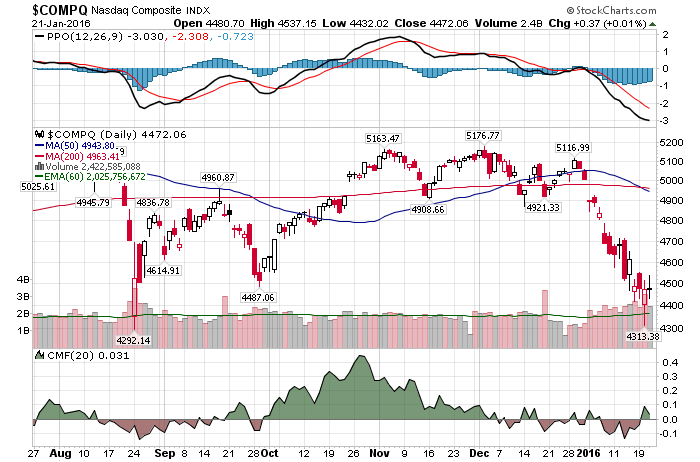

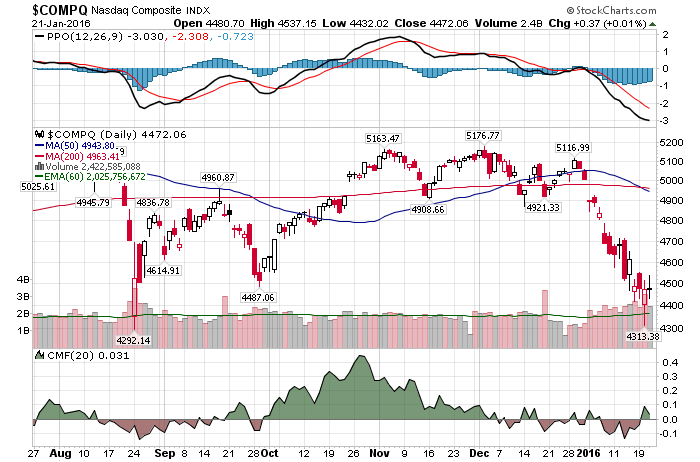

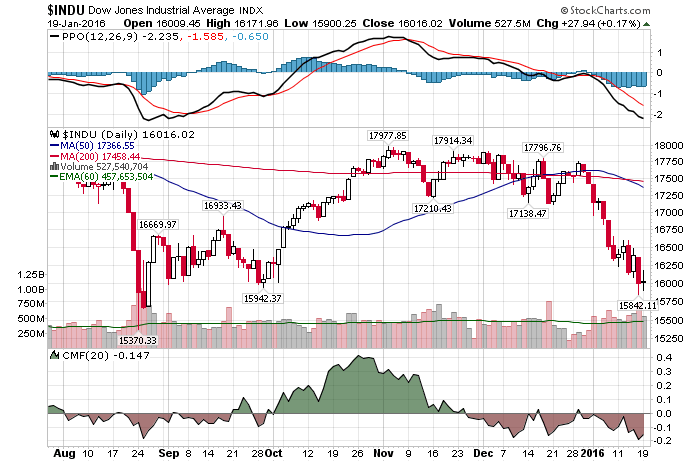

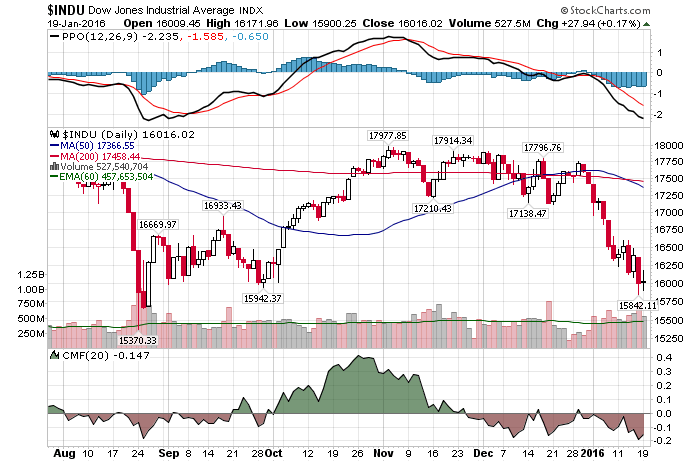

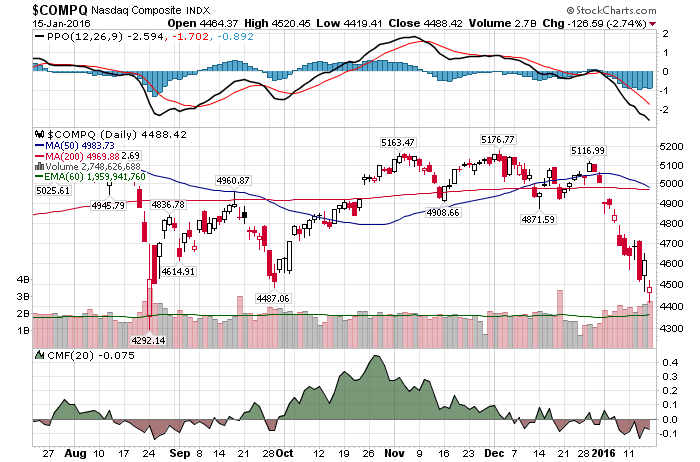

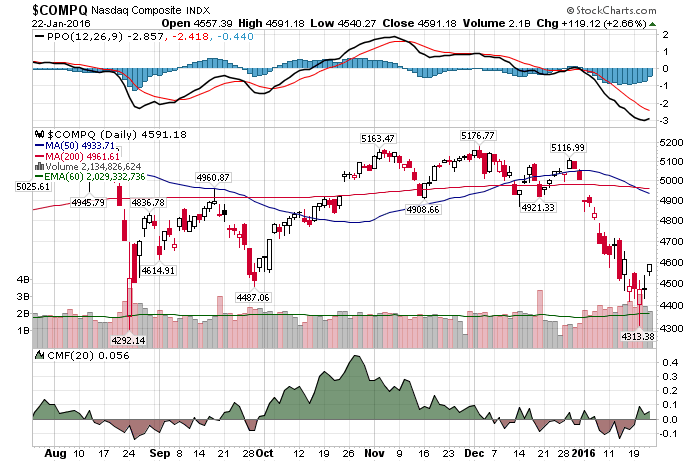

それぞれナスダックは2.7%、S&P500は2%、ダウ平均は1.3%の上昇。出来高は前日と比べて少なめ。上昇銘柄が下降銘柄を、ダウ平均では8:1、ナスダックでは4:2の割合で上回る。

今週は、ナスダックは2%、S&P500とダウ平均は1%高く終了。

ブレント・クルードとウエスト・テキサスオイルが8%以上上昇し1バレル$31を上回り、オイル及びガス関連株が市場を牽引。ネット関連と金融関連も大幅反発した。

Stocks capped a volatile week with big gains Friday, boosted by positive housing and manufacturing U.S. data and bullish comments out of Europe.

The Nasdaq soared 2.7%, the S&P 500 rose 2% and the Dow Jones industrial average advanced 1.3%. Volume was lighter across the board vs. the prior session, according to preliminary figures. Winners trounced losers by an 8-to-1 margin on the NYSE and 4-to-2 on the Nasdaq.

The key indexes closed higher for the week, with the Nasdaq up 2%, and the S&P 500 and Dow 1% higher.

Oil and gas stocks led in the stock market today, as both Brent crude and West Texas intermediate surged more than 8% to above $31 a barrel. Internet and bank stocks were also big gainers in the broad rally.

http://www.investors.com/market-trend/stock-market-today/stocks-cap-week-with-big-gains-2/