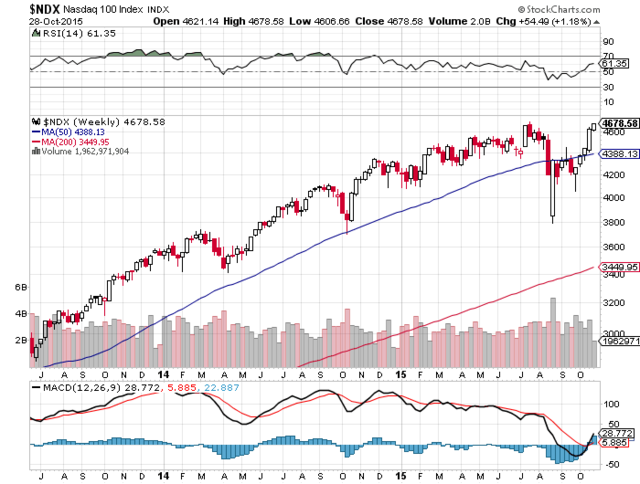

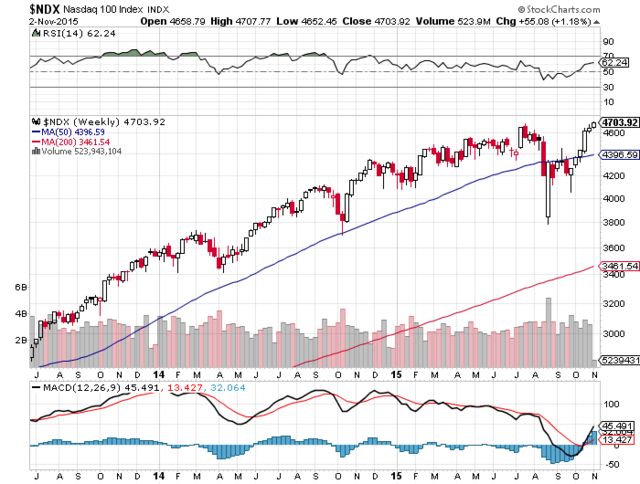

木曜日の株式はインデックスが高値から2%安で二日連続の陰線。ナスダックは0.3%、S&P500は0.1%下落。IBD50は0.2%の小幅高。出来高は減少。出来高の減少と小幅安でインデックスのディストリビューションデーは回避された。広い範囲の売りサイン出ず。

Stocks pulled back for a second straight session Thursday as the indexes set up camp about 2% off all-time highs. The Nasdaq trimmed 0.3%, while the S&P 500 eased 0.1%. The IBD 50 gained 0.2%. Volume declined on both major exchanges. The falling volume and puny losses helped the indexes avoid a distribution day. There were no signs of widespread selling.

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/110515-779441-major-stock-indexes-dont-do-much-but-facebook-gaps-up-aggressively.htm#ixzz3qfhzGkV6

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

カテゴリー: IBD

株式は小反落、エクペディア、フェイスブックなど売り買い交錯 – IBD

木曜日の相場は、寄りは決算方向で大きく動いたが、売り買い交錯でとても静かである。ダウ平均とS&P500は0.1%の小幅高。ナスダックは0.3%安。

トレードは水曜日の同じ時間と比較して、出来高は3%低くとても静かであった。

Stocks rolled out to narrowly mixed action in muted trade Thursday, with earnings reports driving a number of dramatic early moves. The Dow Jones industrial average and the S&P 500 gained 0.1% apiece. The Nasdaq eased 0.3%.

Trade was quiet, down about 3% each on the NYSE and Nasdaq exchanges, relative to action at the same time Wednesday.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/110515-779297-stock-open-quietly-mixed-thursday.htm#ixzz3qdW80K4d

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

イエレン議長のコメントにより、株式相場は小反落 – IBD

水曜日の主要株価平均はまちまちな出来高で小幅安。インデックスも、医療およびソフトウェア・セクターで、いくらかの買い活動を見せかけた。米国株で一番重要なナスダック総合指数は、出来高を伴って0.1%以下の安値。通常、出来高を伴った下落はディストリビューションデーとなる。しかし今回のナスダックのケースはそうではない・・

The major stock averages posted mild declines in mixed volume Wednesday. The indexes also disguised some buying activity in the medical and software sectors. The Nasdaq composite, the most important index for U.S. stocks, edged less than 0.1% lower as volume trickled higher. A decline in higher turnover would normally spell a distribution day for that index. But in this case, the Nasdaq did not …

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/110415-779245-stocks-take-a-break-on-janet-yellen-comments.htm#ixzz3qZsP3mOi

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために

値幅が少し改善し、株式は上昇を続ける – IBD

火曜日の株式相場は、最新の決算報告に妨げられずに上がり続けている。S&P500は0.3%高で7月以来の高値を更新。ナスダックは0.4%。両インデックスは日中の上を戻したが、鋭い価格上昇傾向を維持している。数ヶ月の下落傾向の後、ほとんどのインデックスが50日移動平均線を上抜き始めた。

The stock market kept steaming higher Tuesday, unimpeded by the latest raft of earnings reports. The S&P 500 added 0.3%, hitting its highest level since July. The Nasdaq climbed 0.4%. Both indexes gave back some gains late in the day but kept their sharp price uptrends intact. After months of a downward tilt, the 50-day moving averages of the broad indexes have started to turn higher.

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/110315-779015-stocks-continue-rising-as-breadth-improves-some.htm#ixzz3qV8Ogs39

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために

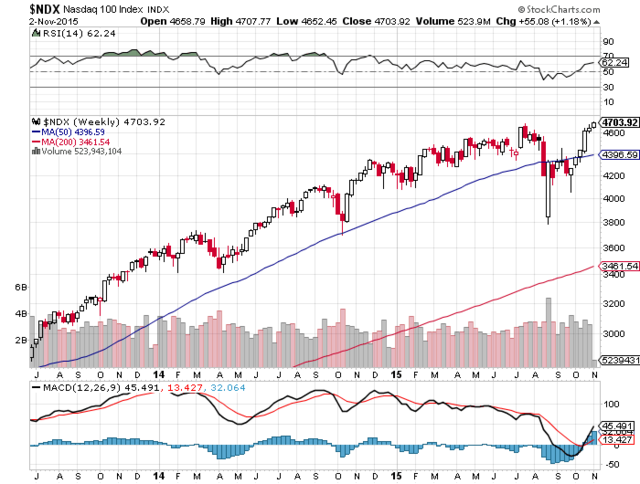

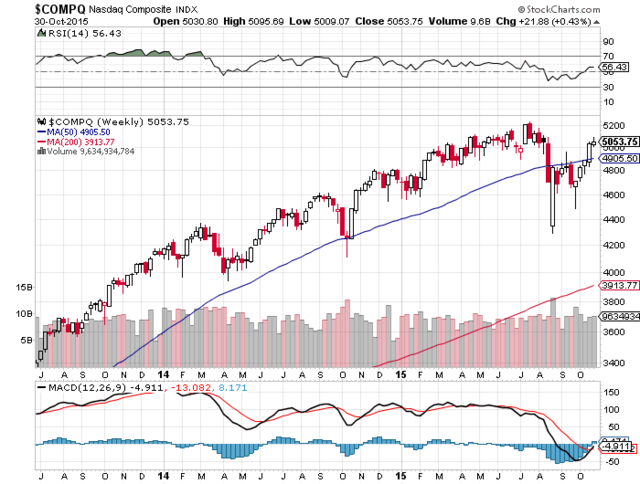

NASDAQ 100が15年来の高値に達っする – IBD

株式は、合併のニュースの騒ぎのなか大きな上昇を記録した。小型株は大幅上昇そ、ナスダック100は15年来高値を記録。小型株のラッセル2000は2.1%、ナスダックは1.5%、S&P500は1.2、ダウ平均は0.9%の上昇。出来高は金曜日のレベルから下がる。

Stocks kicked off the week on solid ground, scoring big gains on a busy day of merger news. Small caps outperformed, and the Nasdaq 100 hit a 15-year high. The Russell 2000 small-cap index jumped 2.1%, the Nasdaq added 1.5%, the S&P 500 rose 1.2%, and the Dow picked up 0.9%. Volume fell from Friday’s levels.

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/110215-778768-buyers-dictate-action-as-nasdaq-100-hits-15-year-high.htm#ixzz3qOMszbkU

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

株式市場は序盤は上昇;クロロックス、エステローダが高い

月曜日の株式は高く寄り付いて、決算、取引ニュースと経済報告でさらに強化された。ナスダックは0.7%、S&P 500は0.5%の上昇。一方で、ダウ平均は0.4%上がった。今日の株式市場は少ない出来高で推移している。

決算報告で、エステローダ(NYSE:EL)は強い決算報告の結果、9%近く200日移動平均線を上回った。カップウィズハンドルベースで、買いポイントの$85.33を超えた。

Stocks opened higher and further strengthened Monday amid earnings, deal news and economic reports. The Nasdaq rallied 0.7% and the S&P 500 climbed 0.5%. Meanwhile, the Dow Jones industrial average rose 0.4%. Trade was running lower across the board in the stock market today

In earnings news, Estee Lauder (NYSE:EL) gapped above its 200-day line and bolted nearly 9% on strong quarterly results. The stock cleared an 85.33 buy point from a cup-with-handle base.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/110215-778577-stock-market-today.htm#ixzz3qLnkStSb

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために

株式インデックスはディストリビューションを受けたが、アップトレンドは維持 – IBD

金曜日のインデックスはディストリビューションを被ったが、ナスダックとS&P 500の5週連続の上昇を止めることはできなかった。ナスダックは0.4%、S&P 500は0.5%の下落。IBD 50も0.5%の下落。全体的に出来高は上昇。出来高を伴った下落はディトリビューションである。

Weak action slapped the indexes with distribution Friday but couldn’t stop the Nasdaq and the S&P 500 from logging their fifth consecutive up week. The Nasdaq dropped 0.4%, while the S&P 500 shed 0.5%. The IBD 50 also fell 0.5%. Volume rose across the board. The combination of losses and rising volume met the definition of distribution.

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/103015-778436-stock-indexes-suffer-distribution-but-market-uptrend-remains-intact.htm#ixzz3q9JNra9J

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

株式市場は下落;スターバックス決算をしくじった – IBD

木曜日の株式相場は出来高を伴わず小幅安。ナスダックは0.4%下落したが、S&P 500は0.1%以下安。小型株のS&P 600は1%下落。IDB 50は0.4%安。出来高は全面的に減少。過去5日の取引中3回の大幅上昇後、木曜日の株式市場は・・・

Stock indexes posted small losses in quiet volume Thursday, curbing any zeal that might have been blooming among the bulls. The Nasdaq stepped back 0.4%, while the S&P 500 shuffled down less than 0.1%. The small-cap S&P 600 dropped 1%. The IBD 50 shed 0.4%. Volume fell across the board. After big gains in three of the previous five sessions, the stock market Thursday was ready for a …

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/102915-778202-stocks-take-well-deserved-rest-starbucks-results-fail-to-wow.htm#ixzz3q0knX6bT

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

GDP速報値が株価先物を鳴らす;アラガン、オーライリーが高い – IBD

株価先物は新規失業保険申請件数とGDP速報の結果から木曜日の時間外の上昇を落とし、小幅安に転じた。

ダウ先物は1時間前の44ポイント高から転じて、適正市場価格から57.2ポイント安。ナスダック100先物は18ポイント上昇して20.7ポイント下落。S&P 500先物も転じて6.7ポイント下落。

株式市場は水曜日のFRB発表から今週はナスダックは今まで1.3%、S&P 500が0.7%上昇している。両インデックスは5週連続の上昇である。

Stock futures shed Thursday’s premarket gains and reversed to moderate losses after mixed reports on unemployment claims and Q3 GDP growth.

Dow futures dropped 57.2 points below fair market value, down from a 44-point advance an hour earlier. Nasdaq 100 futures shed an 18-point gain and dropped 20.7 points. S&P 500 futures also reversed, trading down 6.7 points.

The stock market today received a boost from the Federal Reserve Wednesday that left the Nasdaq up 1.3% so far this week and the S&P 500 showing a 0.7% gain. Both indexes are working on what would be a fifth straight weekly advance.

More important for growth investors, small caps are having a strong week. The Russell 2000 surged 2.9% Wednesday — it’s strongest session since Dec. 17, 2014. That lifted the small cap gauge clear of its 50-day moving average and put it ahead 1.1% for the week. Even so, the index remains well below its next test of resistance at its 200-day line.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/102915-778054-stock-futures-point-to-lower-open.htm#ixzz3pxjrKG7a

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために

FOMCの発表を受け、小型株が上昇 – IBD

水曜日の株式市場は決算発表とFOMC発表を受け大幅上昇。予想通りFOMCが金利を据え置きにしたため主要株価は上昇したが、12月に利上げの余地を残している。小型株は精彩を欠く成績の後に大幅上昇した。ラッセル2000は2.9%の大幅上昇。IDB 50は1.6%、ナスダックは1.3%の上昇。

Earnings reports took a back seat to the Fed Wednesday, and the end result was pretty darn good. Major averages yo-yoed to a bullish close after the Fed, as expected, kept interest rates unchanged but left the door open for a rate hike in December. Small caps outperformed after a period of lackluster performance. The Russell 2000 jumped 2.9%. The IBD 50 gained 1.6%. The Nasdaq rose 1.3%, the …

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/102815-777968-small-caps-lead-solid-up-session-as-fed-stands-pat.htm#ixzz3pvVf3bGx

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために

株式はFOMC発表前に小反発;アカマイ、ベリスクがナスダックの重荷に – IBD

水曜日の株式市場の序盤は、午後のFOMCポリシー発表前に小反発。S&P 500とダウ平均は0.4%の上昇。ナスダックはアカマイとベリスクの大幅減益の影響で0.2%。

出来高は穏やかで、火曜日の同時刻と比べてナスダックで13%減、NYSEで4%減。今日の株式市場の焦点は午後2時に予定されているFOMC発表であるが、エネルギー情報局が午前10時30分に毎週の原油在庫データを報告するので、原油価格にも注意が必要である。

Stocks edged higher at Wednesday’s open, as earnings pushed early action ahead of the Fed’s policy announcement this afternoon. The S&P 500 and the Dow Jones industrial average each gained 0.4%. The Nasdaq added 0.2%, held back by heavy losses from Akamai Technologies (NASDAQ:AKAM) and Verisk Analytics (NASDAQ:VRSK).

Volume was soft, down 13% on the Nasdaq and 4% lower on the NYSE, vs. trade at the same time Tuesday.

The Fed’s policy announcement, due out at 2 p.m. ET, remains the focal point for the stock market today, but keep an eye on oil prices, as the Energy Information Administration reports its weekly oil inventories data at 10:30 a.m.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/102815-777831-stocks-rise-in-weak-trade-wednesday.htm#ixzz3psTFJNCw

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

【送料無料選択可!】オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために / … |

S&P 500、ナスダックは小幅安だが小型株は大幅下落 – IBD

火曜日は輸送株と小型株が大幅下落したが、主要株式平均のアップトレンドは崩れていない。S&P 500は0.3%、ダウ平均は0.2%、ナスダックは0.1%の小幅安。出来高は月曜日のレベルから増加し、S&P 500に軽いディストリビューション・デーが現れた。ナスダックは下落を回避した。

Transportation stocks got hit hard Tuesday, and small caps lagged badly, but the good news for the bulls was that damage didn’t show up in the major averages. The S&P 500 lost 0.3%, the Dow Jones industrial average fell 0.2%, and the Nasdaq eased 0.1%. Volume rose from Monday’s levels, giving the S&P 500 another mild distribution day. The Nasdaq avoided one with its small decline.

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/102715-777762-sandp-500-nasdaq-edge-lower-but-small-caps-hit-hard.htm#ixzz3pp29klS7

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

株価先物は、アリババに遅れた中国株のラリーのように低く推移 – IBD

火曜日の株価先物は予想よりも弱い9月の耐久消費材報告により寄り付きの損失を深めた。ダウ先物は56ポイント安で始まり下落。S&P 500先物は7.7ポイント安。ナスダック先物は時間外で下落したが、適正市場価格の11ポイント安までもどした。

本日の株式市場は激しいセッションになっている。ワシントンではFOMCが水曜日の午後に政策発表するための2日間のミーティングに入った。

Stock futures deepened their early losses ahead of Tuesday’s open after a weaker-than-expected September durable goods report. Dow futures traded down 56 points and were falling. S&P 500 futures slipped 7.7 points.

Nasdaq futures, which had pared losses over the past hour, reversed and fell 11 points below fair market value.

The stock market today faces a busy session. The Federal Open Market Committee swings into its two-day meeting in Washington, with a policy announcement due out Wednesday afternoon.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/102715-777571-stock-futures-point-lower-tuesday.htm#ixzz3pmQeSG5y

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

株式の大部分は最近の上昇後動かず – IBD

月曜日の株式は過去4週間の上昇から一服し、売り買い交錯で終わった。ナスダックはインデックスの多くを占めているアップル(AAPL)の3%の下落にもかかわらず、わずかに0.1%の上昇。半導体株も弱い。フィラデルフィア・セミコンダクターは2%の下落。しかし、インターネット関連株は強かった。S&P 500は初めに0.4%ほど下落した後0.2%の下落・・

Stocks ended narrowly mixed and took a breather Monday after rising for the past four weeks. The Nasdaq squeezed out an 0.1% gain, despite a 3% drop in index heavyweight Apple (AAPL). Chips stocks were also weak. The Philadelphia semiconductor index slumped 2%. But Internet content stocks were strong Monday. The benchmark S&P 500 fell 0.2% after being down as much as 0.4% earlier in the day. …

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/102615-777479-stocks-mostly-stay-put-after-their-recent-run.htm#ixzz3pjBwfShd

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

【送料無料選択可!】オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために / … |

オープン前に小幅下落;ヴァレアント、レンディング・ツリーに焦点 – IBD

月曜日の株価先物は小幅下落。ダウ先物は19.7ポイント安。ナスダック100先物は適正市場価格より6.9ポイント低い。S&P 500先物は3.9ポイント安に改善。

本日の株式市場は、ナスダックとS&P 500の4週間の続伸と8月以来初めて200日移動平均線を上回り良い傾向である。

迅速なディストリビューション・デーの構築をー大口投資家の売り物の基準ーナスダックは4日間、S&P 500は3日間示した。迅速なディトリビューションの増加が、始まったばかりの上昇トレンドに休みを与えるために止まる限り、問題のないレベルである。

Stock futures were mildly lower and trimming losses ahead of Monday’s start of trade. Dow futures dipped 19.7 points, well off their hour-earlier lows. Nasdaq 100 futures traded a modest 6.9 points below fair market value. S&P 500 futures improved to a 3.9-point decline.

The stock market today starts the week in good standing, with both the Nasdaq and the S&P 500 sitting atop four straight weekly gains and back above their 200-day moving averages for the first time since August. A quick buildup in distribution days — a measure of selling by large-scale investors — left the Nasdaq showing four days and the S&P 500 carrying three. The levels aren’t problematic, as long as the quick buildup in distribution stops to give the young uptrend a break.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/102615-777347-stock-futures-point-modestly-lower-monday.htm#ixzz3pgYyYh2y

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

株式は抵抗線をを上抜けた;火曜日と水曜日はFOMC – IBD

金曜日の株式は、ナスダックが何事もなかったように2つの抵抗性を上抜いた。ナスダックは2.3%、S&P 500とダウ平均はそれぞれ1.1%と0.9%の上昇。IBD 50は0.7%の上昇。ナスダックの出来高は増加したが、NSYEは減少した。

Stocks caught a fast ride Friday, with the Nasdaq speeding past two expected areas of resistance as if they were nothing. The Nasdaq popped 2.3%, while the S&P 500 and the Dow Jones industrial average added 1.1% and 0.9%, respectively. The IBD 50 lagged with a 0.7% gain. Volume rose on the Nasdaq but fell on the NYSE.

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/102315-777245-stocks-clear-resistance-level-fed-to-meet-tuesday-and-wednesday.htm#ixzz3pdRZWvKM

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

【送料無料選択可!】オニールの成長株発掘法 良い時も悪い時も儲かる銘柄選択をするために / … |

楽観主義が始まる、先物が急増;アルファベット、アマゾン、マイクロソフトが牽引 – IBD

金曜日の株価先物はテック株の決算発表と為替の関係で、時間外取引で大幅上昇。ダウ先物は150.8ポイント、ナスダック100先物は119.7ポイント、S&P 500先物は23.2ポイントのの大幅高。

小型株のラッセル200先物は12.4ポイントと異常な強さを示した。

時間外取引で、アルファベット(グーグル)は11%、アマゾンは10%、マイクロソフトも10%とそれぞれ大幅な上昇で、新高値更新。

Stock futures hammered out powerful gains ahead of Friday’s open, boosted by tech-sector earnings reports and global currency issues. Dow futures swept up 150.8 points and were rising.

Nasdaq 100 futures flew at high altitude, up 119.7 points. S&P 500 futures showed a strong 23.2-point gain. Small caps showed unusual strength, with Russell 2000 futures rising 12.4 points.

Alphabet (NASDAQ:GOOGL), Google’s parent company, spelled out an 11% premarket gain after stomping analyst consensus expectations late Thursday. A 16% EPS gain, a 15% rise in revenue and a $5.1 billion share buyback initiative were all part or the third-quarter package. Paid click volume, a carefully monitored metric, jumped a better-than-expected 23%. Alphabet finished Thursday’s regular session a bit less than 5% below a 713.33 buy point in a 14-week cup base.

Amazon.com (NASDAQ:AMZN) held up a 10% advance ahead of Friday’s open after soaring in extended trading on Thursday. The diversified online and tech service giant’s Q3 results showed a 17 cent-per-share profit vs. consensus expectations for a 10-cent loss. Revenue leapt 23%, also better than expected; the closely watched cloud service unit, although only 8% of total revenue, saw sales surge 78%. The stock ended Thursday still in buy range, less than 3% above a 549.88 buy point in a cup-with-handle base.

Microsoft (NASDAQ:MSFT) also scaled up 10%, reporting late Thursday that its fiscal Q1 earnings outpaced consensus projections. A 3% EPS gain easily topped estimates. Revenue fell 7%, less than forecast. The stock closed out Thursday’s session in buy range, less than 1% past a 47.64 buy point in a cup-with-handle base.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/102315-777089-stock-futures-point-sharply-higher-friday.htm#ixzz3pOomCHKN

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

株価はファストレーンに切り替わった;アマゾン、アルファベット(グーグル)が時間外で上昇 – IBD

木曜日の株式は取引が始めるとすぐに上昇し、事実上一日のかなりの利益のすべてを保持した。ナスダックは1.6%上昇、S&P 500は1.7%上昇、ダウ平均は1.9%の上昇。四半期決算の好結果によるマクドナルドの8%の上昇がダウを牽引した。

Stocks took a bold turn Thursday, rising in fast trade and keeping virtually all of the day’s sizable gains. The Nasdaq gained 1.6%, the S&P 500 thrust 1.7% higher, while the Dow Jones industrial average booked a 1.9% gain. McDonald’s (MCD) had a 8% romp that boosted the Dow after the fast-food king reported better-than-expected quarterly results. Small caps trailed the major indexes, with …

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/102215-777046-stocks-switch-to-the-fast-lane-amazon-alphabet-up-after-hours.htm#ixzz3pM2ebIAF

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

株式は大幅上昇;マクドナルド、イーベイ、シトリックスが爆上げ – IBD

木曜日の株式は決算レポートの高波に乗って全力でスターティングゲートを出た。ダウ平均とナスダックは1.2%の上昇。S&P 500は1.1%の上昇。

本日の株式市場は強く、水曜日と比べて、ナスダックの出来高は8%、NYSEは33%の増加。

第三四半期の決算の結果で、マクドナルドは7%、アメックスは6%の大幅上昇。

イーベイは12%の大幅高で、ナスダック100とS&P 500を牽引。

Stocks sprinted out of the starting gate Thursday, riding a storm surge of earnings reports.The Dow Jones industrial average and the Nasdaq powered up 1.2% apiece. The S&P 500 jumped 1.1%.

The stock market today rolled out in strong trade, with volume on the Nasdaq rising 8% and NYSE volume up 33% over what were also strong early volume numbers on Wednesday.

On the Dow, McDonald’s (NYSE:MCD) soared 7% and American Express (NYSE:AXP) crumbled 6% after reporting Q3 results.

Big cap eBay (NASDAQ:EBAY) swept ahead 12% at the open to lead both the Nasdaq 100 and the S&P 500. The online retail/auction site reported late Wednesday its third-quarter earnings topped consensus expectations. Revenue slipped 2% but matched consensus forecasts. Management raised its full-year earnings outlook to meet analyst consensus. The gain punched shares back above the stock’s converged 10- and 40-week moving averages, to within 9% of its July high.

Read More At Investor’s Business Daily: http://news.investors.com/investing-stock-market-today/102215-776869-stock-gain-in-strong-trade-thursday.htm#ixzz3pJLYZ1YU

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook

インデックスは再び低下、決算の結果により株価のボラティリティが増加 – IBD

水曜日の株式は四半期決算発表の第二セッションの結果で後退した。一方、かつてのマーケットリーダーであったバリアント・ファーマシューティカルズ(VRX)の19%の暴落(ザラ場中は最大39.7%下落)は激しいセクターの交代の再確認が市場を襲った。

バリアントは8/20に大きな出来高を伴って50日移動平均線を割ったときに売りサインが出ていた。

Stocks retreated for a second straight session Wednesday as the quarterly earnings rodeo remained in full swing. Meanwhile, a 19% collapse by former market leader Valeant Pharmaceuticals (VRX) (it was down as much as 39.7% intraday) reaffirmed the violent sector rotation hitting the market. Valeant triggered a sell signal when it undercut its 50-day line in big volume on Aug. 20. The Nasdaq …

Read More At Investor’s Business Daily: http://news.investors.com/investing-the-big-picture/102115-776758-indexes-fall-again-as-earnings-results-boost-stock-volatility.htm#ixzz3pG7Q3CvH

Follow us: @IBDinvestors on Twitter | InvestorsBusinessDaily on Facebook